A Scheme of the Super-Rich, by the Super-Rich, for the Super-Rich

Donald Trump says his tax plan is “a revolutionary change, and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labor and as wages start going up at levels that you haven’t seen in many years.”

No, it’s not.

It’s just another con job from the most successful con artist in history.

Below are nine examples of how this is a plan of the super-rich, by the super-rich and for the super-rich. And unless you are super-rich, this plan will badly hurt you.

- You’ll pay high tax rates. The 10% and 15% tax rates, paid by most Americans, will be replaced with higher rates—12% and 25% rates. This helps the poor and middle class how? Your marginal tax rate would rise by either 20% or 67%.

- Less Income Taxed. Trump says the 12% rate is good because you‘ll get your first $12,000 of income tax-free ($24,000 for married couples). Big deal. Currently, you get $10,400 tax-free ($20,800)* so it’s not much of a boost and you no longer get exemptions for your kids and reduced tax credits for any dependent who is not a child, like say your elderly mother or impoverished brother.

- Trump Will Pay Less Tax. The top tax rate on partnerships and limited liability companies would fall from 39.6% to 25%. Trump has more than 500 such businesses. His tax rate would fall by more than a third.

- Corporations Pay Less. The corporate tax rate would be cut from 35% to 20%. This at a time when corporations have record amounts of cash and interest rates are super low. The savings will make it easier to buy back stocks, which makes executive stock options more valuable because fewer shares make each share more valuable.

- Rewarding Corporate Tax Dodging. Companies that used accounting to convert profits earned in America into tax-deductible expenses paid to their offshore subsidiaries will get a tax holiday, bringing the profits back with little or no tax. The taxes avoided by moving money offshore are in effect loans from Uncle Sam at zero-percent interest so this would be a double dip of corporate welfare.

Trump Kids Win. Trump would repeal the estate tax so if he really is worth $10 billion—he’s not—he would save $4 billion. At even $100 million he would save $40 million. While he claims his tax plan “is not good for me,” it will, undoubtedly, be good for Donald Jr., Eric, Ivanka, Tiffany and Barron Trump.

- Trump Pays 85% Less. Had the tax plan been in effect in 2005 Trump would have paid a tax rate of less than 3.5%, a rate lower than the poorest half of taxpayers. That’s because he would repeal the Alternative Minimum Tax. Here is our exclusive on his tax return from March.

- More Jobs Would Go Offshore. While only vaguely described, the plan would encourage companies to move jobs offshore, the exact opposite of what Trump administration said. Poor countries overseas will offer tax-free profits or minimally taxed profits in return for jobs—jobs that will pay very low salaries by American standards. American companies that offshore jobs to these countries will get a twofer—cheap labor and no taxes.

Saving Gentleman Ranchers. Each year about 2.6 million Americans die. Fewer than 5,000 of them pay any estate tax. Trump drags out the old lie that this is to save the family farm. Only 80 of those 5,000 taxable estates include farm property—and they are gentleman farmers like Ted Turner (pictured here) with his herds of buffalo, not yeoman farmers working tractors in their corn and soybean fields.

Saving Gentleman Ranchers. Each year about 2.6 million Americans die. Fewer than 5,000 of them pay any estate tax. Trump drags out the old lie that this is to save the family farm. Only 80 of those 5,000 taxable estates include farm property—and they are gentleman farmers like Ted Turner (pictured here) with his herds of buffalo, not yeoman farmers working tractors in their corn and soybean fields.

The bottom line: This plan only makes sense if you believe, like Trump and many Congressional Republicans, that America’s greatest economic problem is that the rich do not have nearly enough. If you believe the rich just cannot afford to invest in ways that create jobs and grow the economy this is the plan for you.

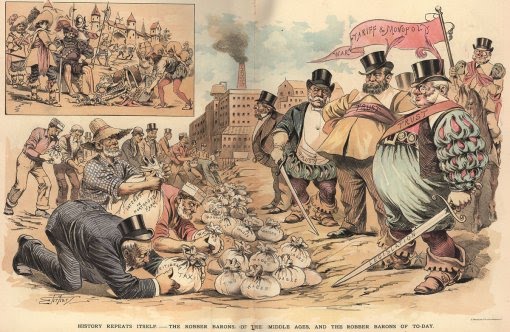

Featured Image: History Repeats Itself: The Robber Barons of the Middle Ages and the Robber Barons of Today, by Samuel Ehrhardt (1862–1937); Puck, Nov. 6, 1889.

*The dollar figures in this sentence have been updated.

Trump Kids Win. Trump would repeal the estate tax so if he really is worth $10 billion—he’s not—he would save $4 billion. At even $100 million he would save $40 million. While he claims his tax plan “is not good for me,” it will, undoubtedly, be good for Donald Jr., Eric, Ivanka, Tiffany and Barron Trump.

Trump Kids Win. Trump would repeal the estate tax so if he really is worth $10 billion—he’s not—he would save $4 billion. At even $100 million he would save $40 million. While he claims his tax plan “is not good for me,” it will, undoubtedly, be good for Donald Jr., Eric, Ivanka, Tiffany and Barron Trump.