Finally, No. 1 at Something—He’s Put More People Out of Work than Ever Before in U.S. History.

Here’s an awful truth our government will tell you but not for some weeks to come: as of today more than 20% of American workers are unemployed.

That means more than 32 million Americans in the labor force are without work, the vast majority because of the coronavirus pandemic.

That’s a conservative estimate, for reasons explained below, based on my analysis of the official federal government reports.

The portion of American workers without work is now at its highest level since the Great Depression, though the Bureau of Labor Statistics announcements confirming this won’t show it until the first week of May—or, more likely, in June or July. The bureau’s monthly announcements are based on data through the midpoint of the previous month.

The data I analyzed indicates that the recent estimate by Federal Reserve economists that unemployment will reach an unprecedented record 32% is entirely plausible and may be an understatement.

Historical Perspective on Joblessness

In 1933, when the U.S. had a population of only 126 million, 12.3 million were unemployed. That was just short of 25% of the labor force, up a point from 23.6% in 1932, the year voters chose Franklin D. Roosevelt for the White House.

Since then, the highest jobless rate was 19% in 1937. The highest rate since World War II was 10.8% in 1982 when Ronald Reagan was president.

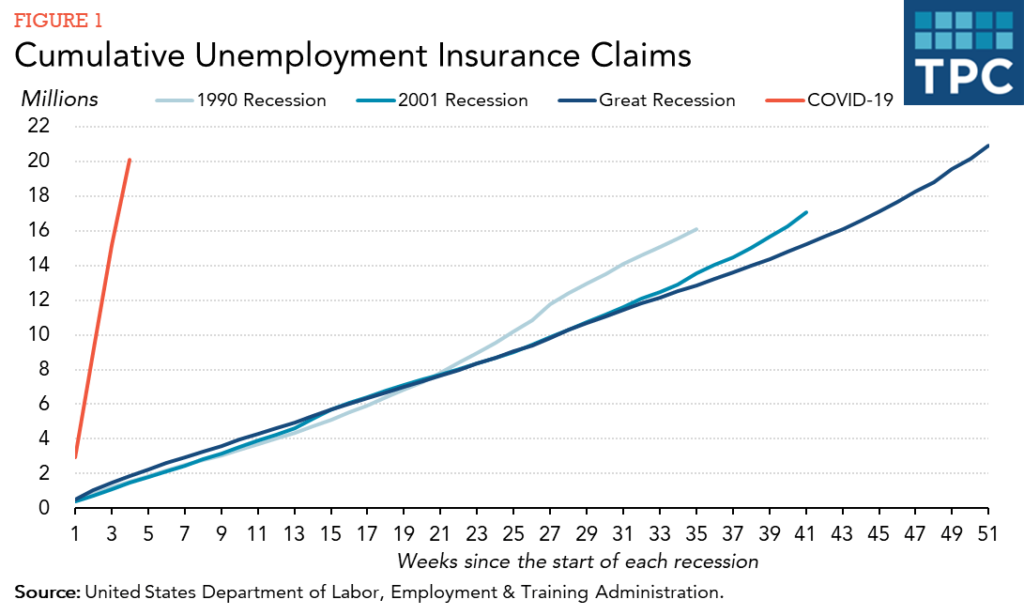

In this century the peak jobless rate was 9.9% in 2009 as the Great Recession that began under President George W. Bush consumed much of the wealth of the middle class and minorities, while Congress made financial investors richer than ever by bailing out Wall Street and turning its back on most homeowners.

Estimating Job Losses

How did I come up with these numbers, 20% jobless and 32 million Americans out of work?

In February, 4.4% of the labor force was unemployed, the federal Bureau of Labor Statistics reported on March 9. That was 7.1 million people out of work using the government’s narrowest measure of joblessness, known as U-3. Using a much broader measure known as U-6, the jobless rate at the start of March was 8.7%.

Over the next seven weeks, initial claims for unemployment benefits were filed by nearly 24.9 million American workers.

Add those two numbers: 32 million people are without work as of last week.

That’s 19.7% of the labor force.

More Claims Filed, Faster

If just a half million people filed jobless claims between April 20 and today, the unemployment rate has exceeded 20%. Does anyone reasonably expect that the initial unemployment benefit claims report that we will get on April 30 will be that small?

I asked Jeff Faux, a founder of the Economic Policy Institute, about my numbers. “At least 20 percent” is certainly reasonable, indisputable, I think,” Faux replied. “Given those who don’t qualify for UI [unemployment insurance] or otherwise don’t get picked up, it is most probably an undercount.”

Elise Gould, another EPI economist, noted that “the latest UI claims data from today, these job losses translate into an unemployment rate of 18.3%. But that doesn’t tell the whole story” which you can read here.

Dean Baker, another liberal economist, said he wants to “focus on the prime age employment rates—likely down by around 15 percentage points.” Prime age is age 25 to 54 so it excludes college students and people who retire early.

The Tax Foundation, a conservative group that dislikes taxes intensely, uses a much smaller estimate of only 12.4% of the workforce has applied for or is collecting jobless benefits.

States Overwhelmed

No matter whose figures you decide to rely on, the jobless numbers would be higher but for the state systems for claiming jobless benefits being overwhelmed. Many people have reported they cannot complete their claims and others say they are waiting until those systems are not so overwhelmed because they can file retroactively to when their employment ended.

No matter whose figures you decide to rely on, the jobless numbers would be higher but for the state systems for claiming jobless benefits being overwhelmed. Many people have reported they cannot complete their claims and others say they are waiting until those systems are not so overwhelmed because they can file retroactively to when their employment ended.

California’s Employment Development Department is so overwhelmed that it has told people on unemployment that they don’t need to report their efforts to find work. Normally people who don’t check in weekly to report their efforts to find work would be kicked off the unemployment benefit rolls.

We reported a month ago that before the pandemic seven of every eight jobless benefits claims in Florida was rejected. With the pandemic benefit, seekers far outstrip the capacity of the state’s jobless benefit system to accept claims. That system, set up under Senator Rick Scott, then the Sunshine state’s Republican governor, was designed to reject applicants, critics charge.

$600 a Week ‘Too Generous’

While there will be examples here and there of people who went off unemployment because they found jobs, overall the trend is to massive loss of jobs. In addition, many freelancers and gig workers could not even apply for benefits until last week and some are being turned away, further suppressing the official measures of joblessness.

As many as 15 million Americans are independent contractors, a study by two eminent Princeton University economists using data only through 2015 found. Almost 7% of workers are independent contractors, a 2018 Bureau of Labor Statics analysis concluded. That’s more than 11 million workers.

Many gig workers like Lyft and Uber drivers have been notified that they will receive nothing from their state government. However, they may still eventually get $600 a week from the Coronavirus Aid, Relief, and Economic Security Act.

Those $600 payments are also under attack as too generous. Senators Lindsay Graham of South Carolina and Ben Sasse of Nebraska are among those Republicans asserting that $600 a week is too generous, encouraging loafing instead of working.