Ten Years After His Casino Business Failed, He Was Still Writing Off Losses

In 2005, Donald J. Trump married model Melanija Knavs, his third wife. That year, the real-estate mogul and newly minted TV star earned $153 million dollars, about $3 million a week. That’s far more than all but a tiny sliver of the U.S. population.

The newlyweds paid $36.6 million of that year’s take in federal income taxes, a rate of 24%, putting the Trumps in much the same tax league as any other two-earner professional couple making about $400,000 a year.

Or to put it another way, Donald Trump was paid that year like a member of the 0.001%, but he paid taxes like the 99%. And by at least one measure, he paid like the bottom 50%.

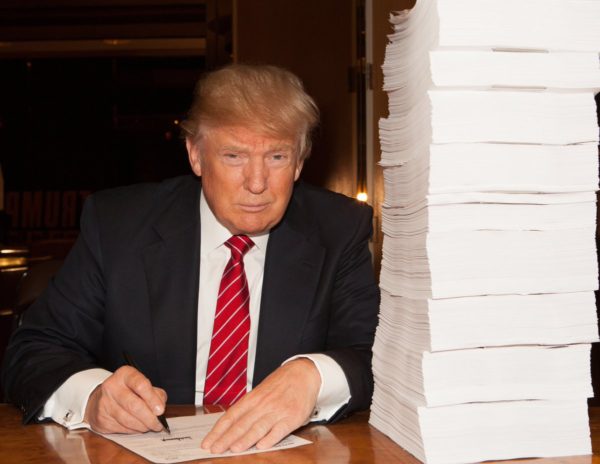

DCReport has obtained Donald Trump’s Form 1040 federal tax return for 2005. There’s no smoking gun there, no obvious evasion, but clearly some bending of the tax laws almost to the breaking point. The document offers a rare glimpse at how a super wealthy couple can manipulate and manage our complex tax laws to reduce their obligations far below rates paid by typical salaried professionals or even blue-collar wage earners.

The White House confirmed the authenticity of the tax returns. “Despite this substantial income figure and tax paid,” the White House said in a statement, “the dishonest media can continue to make this part of their agenda, while the President will focus on his, which includes tax reform that will benefit all Americans.”

Trump’s lawyers have said that any audit of the 2005 tax return is now closed. However, the president has made it clear, since he took office, that he has no intention of making public his tax returns.

What’s Not There

The 1040 shows how Trump obtained money—salary, business profits, dividends and the like. But there is still far more that it doesn’t say. It does not name the sources of his vast income, whether rich golfers playing on his various courses or Russian oligarchs visiting his various hotels. The identities of companies and individuals who paid Trump would be disclosed in the hundreds of pages of schedules, statements and other attachments which a 1040 only summarizes.

Nor does the 1040 distinguish between Trump’s business and personal expenses—money spent traveling in his personal jet between homes and offices in New York and Florida or between hotels and golf courses around the world. There are no specifics on how much he wrote off for business dinners or gifts or even the vast sums he depreciates each year from his buildings.

If you would like to see more journalism like this, please help. DCReport.org is a nonprofit organization. Like you, we want a government that is moral, ethical and answerable to the citizens.[wpedon id=”26″]

There is one clear expense, however, that can be discerned because portions of Trump’s 1995 state tax returns became public last fall. Trump got out of repaying nearly $1 billion he borrowed for his failed casino business. When you don’t repay a loan Congress says that money is income and you owe taxes on it immediately.

Instead, Trump made use of an abusive tax shelter that Congress soon closed to newcomers. Like magic, the tax shelter converted what should have been a tax bill of about $360 million into future tax breaks. Ten years later, on his 2005 return, Trump was still saving tax dollars thanks to that tax shelter. Trump has refused to release his tax returns.

A Dual-Tax System

To understand the Trump tax returns it’s important to realize that America has two income tax systems. The regular income tax was supplemented by a parallel tax system, signed into law by President Ronald Reagan in 1986, called the Alternative Minimum Tax or AMT.

How these two systems interact is central to understanding the Trumps’ taxes.

Viewed in terms of the regular federal income tax system, here is what Trump did:

Trump reported $152.7 million of income. He also reported $103.2 million of negative income, the remainder of the roughly $918 million tax shelter he bought in 1995. That deal was disclosed earlier in three summary pages of his 1995 Connecticut, New York and New Jersey state income-tax returns.

That Trump had only $103 million of his $918 million tax shelter left in 2005 also tells us something about his past income. Using up the other $815 million of negative income in the tax shelter indicates that he earned an average of $81.5 million annually during the 10 years from 1995 through 2004.

Deducting the negative income lowered Trump’s adjusted gross income or AGI to $48.6 million. AGI is the last figure on the bottom of the front page of a federal tax return.

From that, the Trumps took $17 million in itemized deductions, which are not specified. That left $31.6 million of taxable income.

The Trumps paid just $5.3 million of regular federal income tax. Measured against their cash income of almost $153 million their federal income tax rate was 3.48%.

That figure is slightly lower than the tax rate paid by the poorest half of Americans. The half of taxpayers whose income was less than $33,485 that year paid 3.51% of their money in federal income taxes.

Caught by the AMT

Trump’s total federal tax bill was larger, though, because of the Alternative Minimum Tax or AMT.

The President, in writing, has called for eliminating the Alternative Minimum Tax. Now we know one reason why—he lives like a king, but wants to pay taxes like a Walmart cashier.

All high-income Americans must calculate both their regular income tax and their AMT income tax and pay whichever is larger.

Most of that $103 million of negative income was ignored under the AMT, which meant that for tax purposes Trump’s income was larger than under the regular system.

The Trump income subject to AMT was $111.7 million, according to Daniel Shaviro, a New York University law professor who as a Congressional staffer helped draft the AMT three decades ago.

The Trumps paid $31.3 million in AMT which, together with the regular tax, made their total federal income tax $36.6 million.

Viewed in terms of their positive income of almost $153 million the total Trump tax bill came to 24%. That’s in the range paid by two-income career couples who both work all year to earn about $400,000. The Trumps income was $418,460 per day.